Collector

Carla Purdome

County Collector

Physical Address:

300 E. Old Main St.

Yellville, AR 72687

Mailing Address:

P.O. Box 590

Yellville, AR 72687

What does the Collector do?

The Collector's office collects property taxes to help support schools, cities, roads, jails, and county expenses based on millage rates set by local governments and voters. These taxes are about 1% of the value of your home, car, and other items that you may own.

How do I pay my property taxes?

Taxes may be paid with a check on current accounts only, money order, cash, cashier’s check or credit card. Marion County Collector's Office accepts online credit card payments for taxes or you may pay over the phone with a credit card by calling 870-449-6253. Taxpayers will be able to pay their personal and real estate taxes online by clicking the button below. There is also a drop box for your convenience located on the South side of the square near the handicap accessible entrance.

Mail checks to:

Marion County Collector

P.O. Box 590

Yellville, AR 72687

When are my taxes due?

Property tax bills are usually mailed by the end of March and must be paid by Oct. 15 to avoid a penalty. If taxes are not paid, license tags cannot be renewed and penalties will be applied. Partial payments are also accepted throughout the year on current taxes.

Property must be assessed between January 1st and May 31st each year. Taxes are due by October 15th the following year.

A 10% late assessment fee will be added to anyone assessing personal property after the May 31st deadline. (New purchases will have 30 days after purchase to assess without penalty) A 10% penalty will be added to Personal Property and Real Estate paid after October 15th plus 10% annual interest on Real Estate.

You can view your tax information at: https://www.actdatascout.com/RealProperty/Arkansas/Marion

There are tabs for Real Estate and Tax Records (Personal Property).

Homestead Credit

With regard to homestead credit, in no event shall a property tax credit for the current tax year be allowed a property owner after October 15th.

Property owner may contact the following if there are disputes:

Arkansas Department of Finance and Administration

ATTN: Tax Credits Section – County Reimbursement Certification

P O Box 8054

Little Rock, AR 72203

Telephone: (501) 682-7106

Other Helpful Numbers:

Marion County Deputy Prosecuting Attorney:

870-449-4018

Marion County Revenue Office:

870-449-6535

Other Helpful Links:

County Office Hours

Monday - Friday: 8:00 a.m. - 4:30 p.m.

Address:

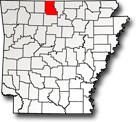

Marion County, AR

300 E. Old Main St., Yellville, AR 72687